For 2023, they are: 68¢ per Kilometre for the first 5,000 kilometres driven. 62¢ per Kilometre driven after that. Check your pay details going back to January 1.

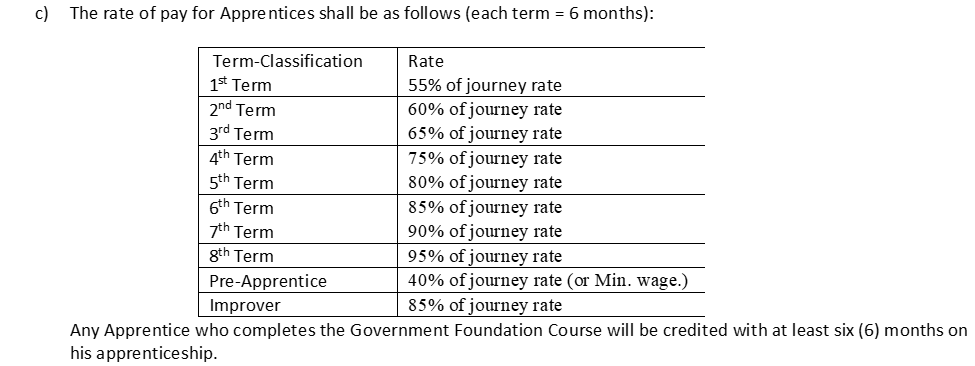

Want to go union?

Attached below is our current independent collective agreement. All you have to do is “certify” the company union by signing cards and then be willing to back up your fellow workers as we negotiate with the contractor to sign our standard agreement. 55% of your bricklayers or masonry craftworkers who work for the company have to sign a certification card and then, the company is union. Contact Geoff at 778-847-2472. Once union the member employees determine what their demands are.

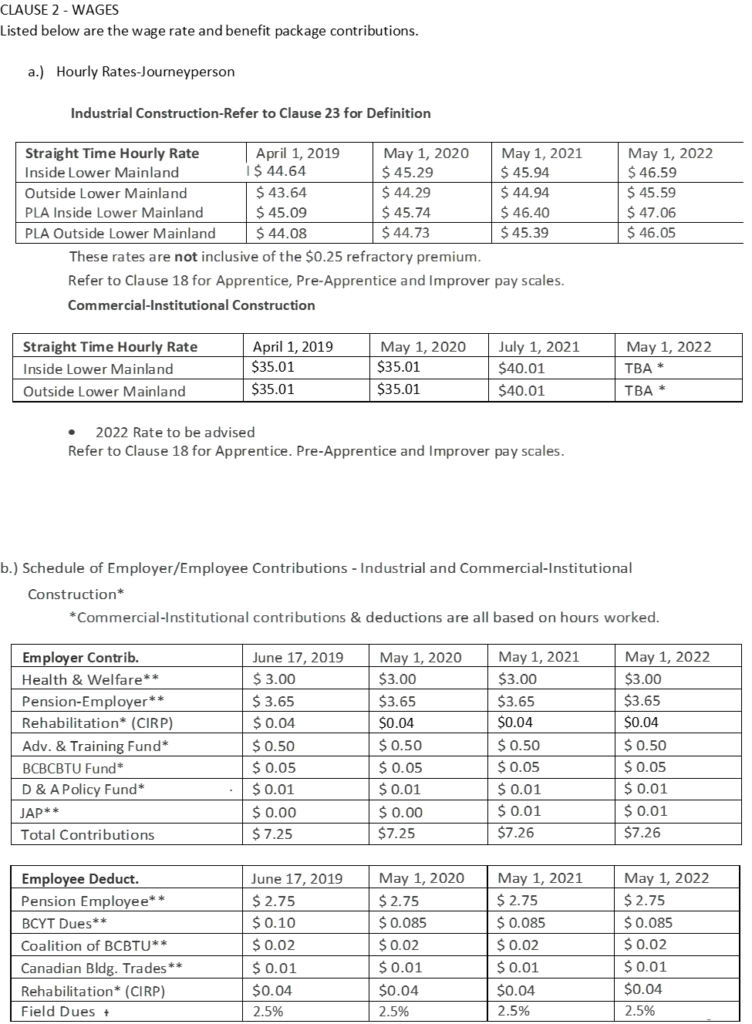

Union Rates and Benefits Click Here OR see below…

ORGANIZE…Bricklayers and Masonry Support Workers sign these cards and go union without a secret ballot. Your signed card is guarded for secrecy, no one knows except you, the union representative and the Labour Relations Board Officer. From the BC Labour Relations Board

Certification 23. If the board is satisfied that (a)on the date the board receives an application for certification under this Part at least 55% of the employees in the unit are members in good standing of the trade union, and (b)the unit is appropriate for collective bargaining, the board must certify the trade union as the bargaining agent for the employees in the unit. Contact Geoff Higginson 778-847-2472.

New CRA KM Allowance set to 61 cents per kilometer.

Reasonable per-kilometre allowance

If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax.

The per-kilometre rates that we usually consider reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations. Although these rates represent the maximum amount that you can deduct as business expenses, you can use them as a guideline to determine if the allowance paid to your employee is reasonable. The type of vehicle and the driving conditions are other factors used to determine whether an allowance is considered to be reasonable.

We consider an allowance to be reasonable if all of the following conditions apply:

- The allowance is based only on the number of business kilometres driven in a year

- The rate per-kilometre is reasonable

- You did not reimburse the employee for expenses related to the same use of the vehicle. This does not apply to situations where you reimburse an employee for toll or ferry charges or supplementary business insurance, if you determined the allowance without including these reimbursements

When your employees fill out their income tax and benefit return, they do not include this allowance in income.

Reasonable allowance rates

For 2022, they are:

- 61¢ per kilometre for the first 5,000 kilometres driven

- 55¢ per kilometre driven after that

In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

For prior-year rates, see Automobile allowance rates.

Svend Maltesen Masonry 14% hourly rate hike July 1st.

Good news for union bricklayers on the commercial institutional side. Svend Maltesen Masonry and BAC Local 2 have successfully negotiated a new independent wage package. Hourly journeyman wage up five bucks to $40.00 an hour plus holiday/vacation and benefits. Total package $51.00 plus per hour as of July 1 2021. Svend Malteson Masonry has been a leader in the industry for years and once again came to the table with a forward looking proposal to adequately pay Bricklayers for their skilled capital and to “raise the line” on quality Masonry installations. Skilled Masons are worth the dough. Thanks to the Maltesen team for pushing the envelope.

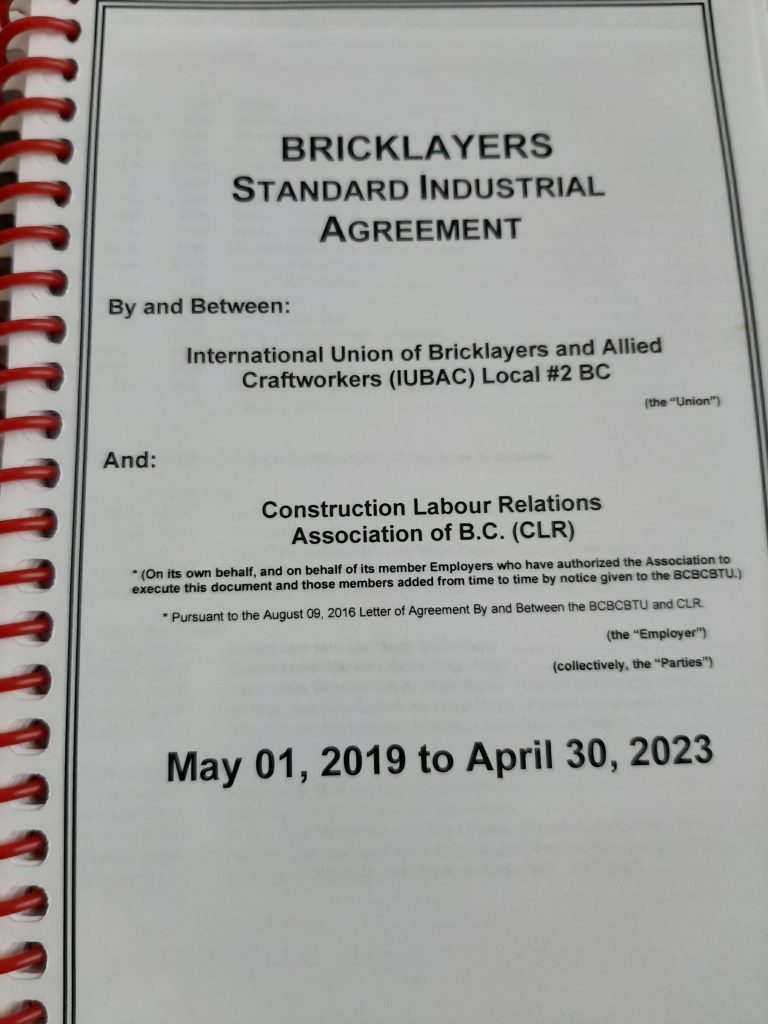

New Agreement Booklets coming off the press soon…

Electronic Pay Details

One of our Contractors has been giving electronic statements to some members working for them and mailing statements to others based on whether they are “full time” or hired on a more job to job basis. The union has notified the CLRA and the Contractor that all members should be treated the same.

We will keep you informed. Please contact the hall if this has been a problem for you.

Ontario Bricklayers Agreement-Travelling Members

In Ontario the Ontario Provincial Conference governs agreements for BACU Locals and IUBAC Locals. IUBAC Local 2 BC has arranged reciprocal arrangements with the health and welfare and pension plans for all locals in Ontario. Attached here (click) is the BACU Agreement and here (click) is the IUBAC Agreement. The terms are the same essentially. For reciprocity you will have to sign reciprocity papers to bring your money home for the benefit plans.

Safe travels if you are heading that way. If you have any questions call the union hall or the president.

Site Specific Indoc at Home

May 23, 2020 Update…CIMS Project Manager at Domtar says doing the indocs at home are optional (We say NO period). If you ended up doing one at home record the day and time you started and the finish time if longer than 4 hours. If your pay detail doesn’t show the hours for the indoc notify the union hall.

The statement below was sent to the CLRA and Contractors via email this evening. (May 21, 2020) re: On Site Indoc Only

Doing site indoctrinations from home is not contemplated in our collective agreements and thereby has to be negotiated or enabled.

Our position is that no member can be required to provide a computer or laptop just to do an indoctrination.

Indoctrinations are work for the employer and therefore have to be paid. They are subject to a minimum of 4 hours pay or time worked if over 4 hours. They are subject to overtime rates as per collective agreement for work outside of the normal work week which amounts to double time.

Members cannot be compelled to do these indoctrinations at home because they have not been negotiated and have to be mutually agreed to under enabling.

In the past BAC Local 2 BC has enabled online indoctrinations for members who were capable as long as they were paid 4 hours minimum. Since the contractors have now insisted that [they] do not have to pay four hours minimum, we do not … therefore withdraw the enabling of this, to the extent any such enabling has existed.

Indoctrinations can be done on site only unless some other enabling agreement is reached with the Union.

This union and some other trades are willing to sit down and discuss negotiating some sort of enabling specific to an upcoming job or jobs and perhaps to other jobs generally.

Job Site Safety-COVID-19 Member Rights and Responsibilities

These are still crazy times. We all must stay informed and when we go to work not accept anything less than what is required by the Provincial Health Officer, Center for Disease Control and WorkSafe BC. Below are links to critical information about what employers have to do to protect you on the job. Hand in hand with that is what we should be doing to protect each other. Remember many of us have contact with older relatives in our home, children and spouses. If you have any symptoms stay home for at least ten days. If you have been exposed to someone with a Positive COVID19 test, then self isolate for 14 days. They are making it much easier to get tested now. Just call your doctor for a telephone consultation and explain your symptoms. You will most likely be given an immediate appointment for testing. Remember if you have to stay home because of the covid you can collect the CERB benefit of 500 per week for up to 16 weeks. Check the link to confirm you would be eligible.

Provincial Health Officer Order re Industrial Camps

Provincial Infection Prevention and Control Officers

Guidance to Construction Sites-BC Public Health