For 2023, they are: 68¢ per Kilometre for the first 5,000 kilometres driven. 62¢ per Kilometre driven after that. Check your pay details going back to January 1.

New CRA KM Allowance set to 61 cents per kilometer.

Reasonable per-kilometre allowance

If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax.

The per-kilometre rates that we usually consider reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations. Although these rates represent the maximum amount that you can deduct as business expenses, you can use them as a guideline to determine if the allowance paid to your employee is reasonable. The type of vehicle and the driving conditions are other factors used to determine whether an allowance is considered to be reasonable.

We consider an allowance to be reasonable if all of the following conditions apply:

- The allowance is based only on the number of business kilometres driven in a year

- The rate per-kilometre is reasonable

- You did not reimburse the employee for expenses related to the same use of the vehicle. This does not apply to situations where you reimburse an employee for toll or ferry charges or supplementary business insurance, if you determined the allowance without including these reimbursements

When your employees fill out their income tax and benefit return, they do not include this allowance in income.

Reasonable allowance rates

For 2022, they are:

- 61¢ per kilometre for the first 5,000 kilometres driven

- 55¢ per kilometre driven after that

In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

For prior-year rates, see Automobile allowance rates.

CIMS Deducting CPP and EI premiums from initial and terminal travel allowance.

This is the most recent info from the tax lawyer.

Hi Geoff,

I have received no correspondence from CRA. The last communication I saw was the abeyance letter you sent me in August.

The CPP and EI treatment should follow that for income tax purposes. The members’ argument was that neither income tax, nor CPP, nor EI should have been deducted. But if CIMS is deducting income tax, then logically they would deduct CPP and EI too, although your members maintain that this is the incorrect result at law (as set out in the income tax, CPP and EI appeals arguments I drafted for you).

Kind regards,

Gareth.

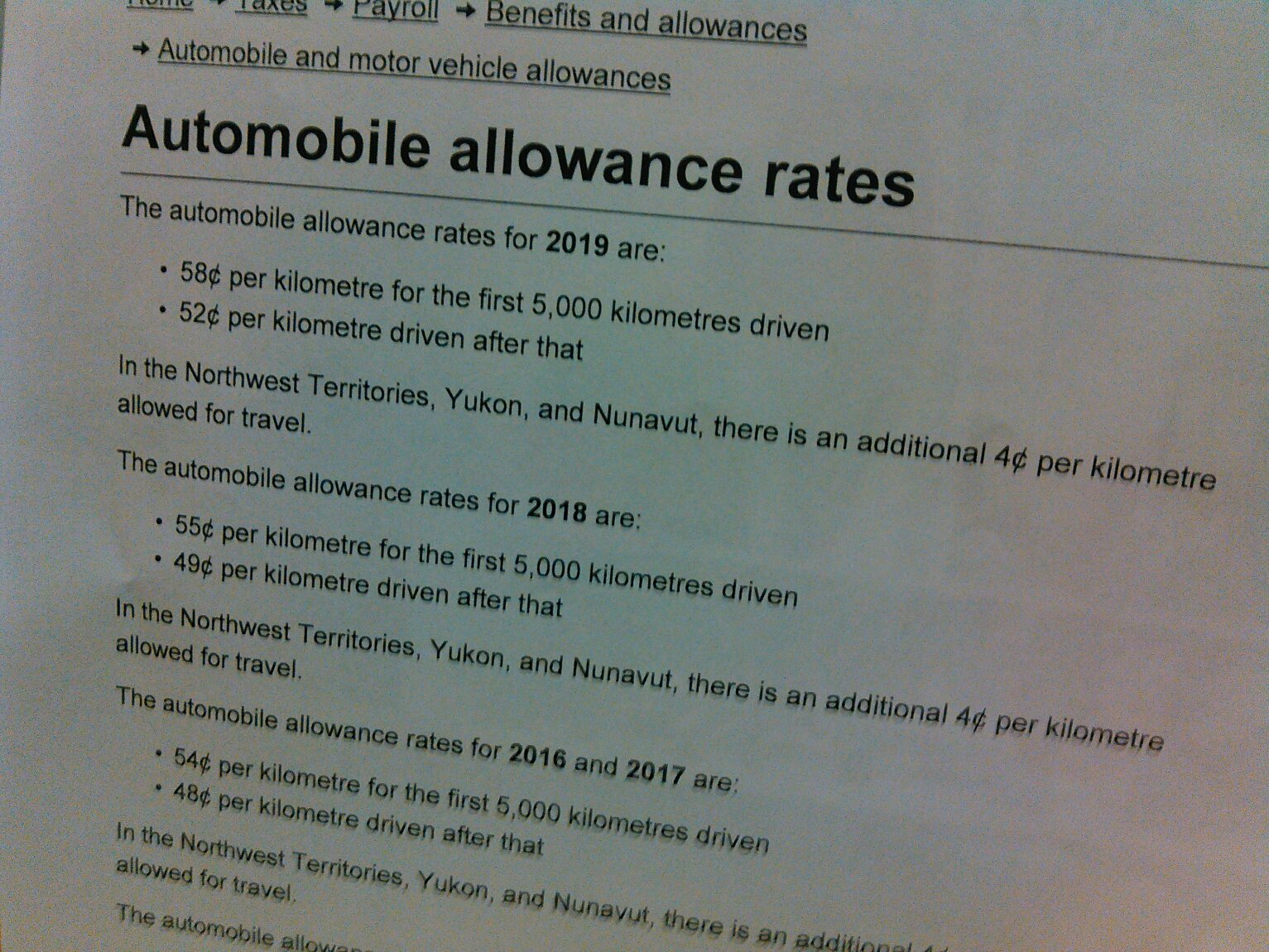

Travel Allowance Rates 2019

Be reminded that travel allowance rates are now 58 cents per kilometre for the first 5000 km and 52 cents per kilometre for every kilometre after that. As of January 1st 2019.